Why HPE Acquired Nimble Storage

Now that the dust has somewhat settled from the acquisition, let’s take a look at why HPE went after this platform. First we need to understand the challenges for HPE around flash and hybrid arrays. If you look at the HPE portfolio starting all the way down at the MSA product line and going all the way up to the 3par all flash, you’ll notice that these products have evolved over time and are based on legacy ideology. MSA is a basic SAN or Direct attach solution born out of the need for shared storage centered around 2 node computing clusters (think MSCS or veritas clustering). 3par is an enterprise class traditional storage platform with the added ability to scale by adding both disk shelves and controller nodes.

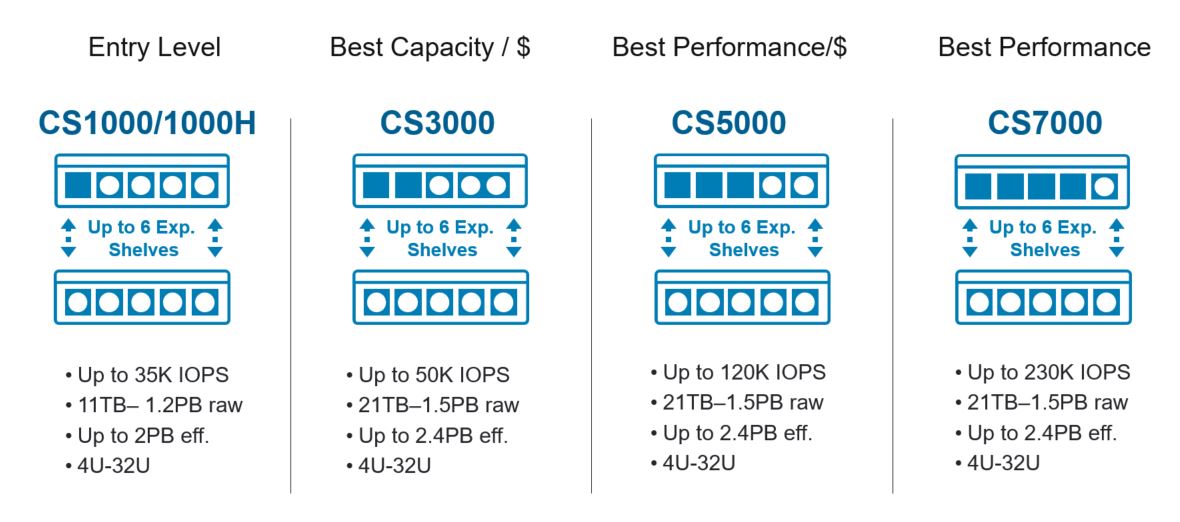

There are clearly a few gaps in here that nimble can fill. First off, the ability to scale both out and up even on the smaller controllers is a huge benefit. Support for both iSCSI and FC out of the box is also included. Most importantly there is a cloud based analytics component to the platform as well. I believe this is a huge part of the reason HPE went after Nimble. Rumors are flying around that the analytics part is going to be added to some of the other storage systems, 3par hopefully.

The Company

Nimble was founded in January of 2008. They have developed some revolutionary concepts and software around storage. According to Gartner, Nimble is the top visionary in the storage space. This is fascinating considering the company in the Magic Quadrant. Below is the Gartner magic quadrant for storage systems as of October 2016.

Hardware

First up let’s take a look at the hardware. As you can see in the image above, it looks like a pretty typical storage device. 2 controller head unit and disk. They come standard with iSCSI and FC capabilities, redundant power, and fans.

The disk situation is pretty unique, they use the 3.5″ disks. In the event you do all flash there are carriers they use, so 2 flash drives are loaded into each slot. See the graphic below;

Nimble has a very strategic advantage over most providers of hybrid and all flash storage. They can do both scale out and scale up, which is very uncommon for this space. Below is a comparison chart between Nimble, EMC XtremIO and Pure. As you can see Nimble keeps up with EMC on the scale of performance and exceeds EMC on the capacity.

Software

Nimble’s biggest advantage comes from the software stack. They are doing exciting things in this space and combining technologies in unique ways. They have a big data predictive analytics platform called infosight. Nimble uses this data to accurately measure real up-time of their systems. They also use this data to identifiy common issues and compatibility problems between versions of software (ie. ESXi 6, ESXi 5.5, Windows Server, etc.). This platform can also assist with more rapid mean time to resolution of issues. Using this analysis data they can develop real datapoints such as

· 99.999% uptime between all systems

· 9 out of 10 issues are detected before the user detects it

· 54% of issues/cases are actually not storage related

· All flash systems can product 1.2 million IOPS with <1 ms of latency and 8PB+ capacity

The intelligence in the software and performance of the system can provide some interesting advantages over competitors.